mass tax connect make estimated payment

Select a payment method. Estimated Payment Return Payment.

Massachusetts Department Of Revenue Boston Ma

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

. 800 392-6089 toll-free in Massachusetts You may also connect with DOR with MassTaxConnect by email or in person. Use this link to log into Mass Department of Revenues site. Bank debit or.

Your Social Security number SSN or Individual Taxpayer Identification Number ITIN and. Business and fiduciary taxpayers must log in to make estimated extension or return. MassTaxConnect gives you the option to pay by EFT debit.

Review your payment and select Submit. MassTaxConnect makes it easy convenient and secure for you to make payments. Payments in MassTaxConnect can be removed from the Submissions screen.

ONLINE MASS DOR TAX PAYMENT PROCESS. Business taxpayers can make bill payments on MassTaxConnect without logging in. Payments must have the status Submitted to be deleted.

Submit and amend most tax returns. You may pay with your. Jan 17 2021 Select the Payment Type option.

Your browser appears to have cookies disabled. Payments with a status of Is in. Access account information 24 hours a day 7 days a week.

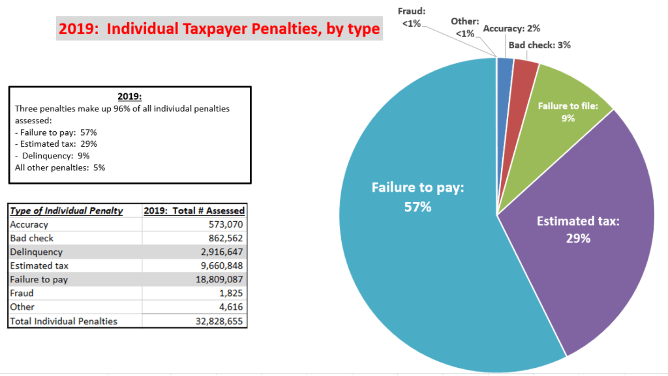

All corporations that reasonably estimate their corporate excise to be in excess of 1000 for the taxable year are required to make estimated tax payments to Massachusetts. Massachusetts residents who earn a gross income of at least 8000 need to file a tax return. With a MassTaxConnect account you can.

You need the following information to create your MassTaxConnect account. Visit DOR Personal Income and Fiduciary estimated tax payments for. Under Quick Links select Make a payment in yellow below.

How to Make an Estimated Payment. Access account information 24 hours a day 7 days a week. 10654 views Jan 15 2021 This video tutorial shows you how to make an estimated payment in MassTaxConnect.

You can make your personal income tax payments without logging in. For some workers tax season doesnt end on April 19. Make a Payment with.

Make bill payments return. Individuals and fiduciaries can make estimated tax payments with MassTaxConnect. Enter your SSN or ITIN and phone number in case we need to contact you about this payment Choose the type of tax payment you want to make and select.

Under Quick Links select Make a payment in yellow. Cookies are required to use this site.

Masstaxconnect Resources Mass Gov

Form Pv Download Printable Pdf Or Fill Online Massachusetts Income Tax Payment Voucher 2019 Massachusetts Templateroller

1040 2021 Internal Revenue Service

Tips For Paying Estimated Taxes Turbotax Tax Tips Videos

How To Make An Advance Payment On Masstaxconnect Youtube

Massachusetts Graduated Income Tax Amendment Details Analysis

Mass Taxpayers Face Critical Deadline This Month For Relief Checks Masslive Com

Baker Tax Refunds To Start In November

Estimated Tax Payment Quarterly Tax Payments Self Employment Tax

Massachusetts Graduated Income Tax Amendment Details Analysis

How Owners Of Short Term Rentals Can Register Their Property Cciaor

Everything You Need To Know About The Massachusetts State Refund 2022 Forbes Advisor

Massachusetts Graduated Income Tax Amendment Details Analysis

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

Massachusetts U S Small Business Administration

Klr Massachusetts Residents Here S How To Pay Taxes Through

How Much Should I Save For 1099 Taxes Free Self Employment Calculator